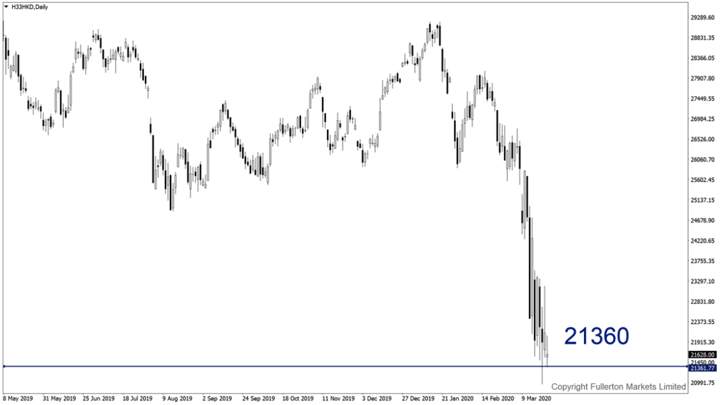

Dollar in Danger? Experts Warn of Inflation Slowdown Ahead

The dollar weakened further after a broad measure of November US inflation slowed while durables orders fell more than expected. Its fate in 2023 will very depend on the US inflation outlook and...