Though Bank of England (BoE) said the hit on economy may not be as severe as initially feared, it does not mean the recovery will be quick. GBP/USD could continue its downtrend.

- Bank of England Monetary Policy Committee unanimously voted to keep interest rates unchanged at the historic low of 0.1%.

- In addition, BoE voted to pump an additional £100 billion into the UK economy. The extra monetary stimulus – known as quantitative easing (QE) – will raise the total size of the Bank's asset purchase programme to £745 billion.

- The central bank sounded more upbeat about the economic outlook than in May. BoE are also moving to slow the pace of asset purchases.

- UK’s economy shrank by 20.4% in April while labour data showed that UK payrolls fell by 600,000 between March and May.

- Furthermore, inflation which is measured by consumer price index (CPI) fell to 0.5% in May from 0.8% in April which is below BoE’s target of 2%.

- Even though the central banks’ MPs felt that the outlook isn’t as bad as they feared, the economic growth may remain tepid due to 2 main reasons extending beyond economics:

1) The fear of a 2nd wave of infections will hold back a complete recovery as social distancing will remain in place until a vaccine is found.

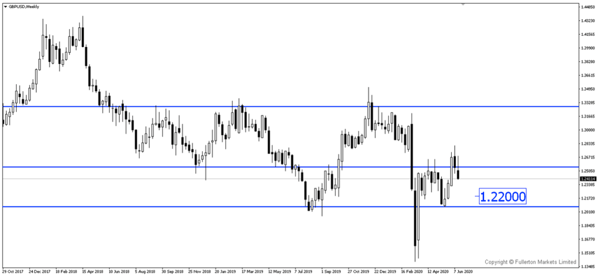

2) UK-EU trade negotiations on post-Brexit will continue to create uncertainties for businesses. - GBP/USD could move lower towards the 1.2200 price level as uncertainty continues to rise.

Fullerton Markets Research Team

Your Committed Trading Partner

Breaking News: Bank of England to Boost Bond-Buying Programme by £100 billion">

Breaking News: Bank of England to Boost Bond-Buying Programme by £100 billion">