Market confidence waned after the best week in decades, USD/JPY may continue to move lower

US stock-index futures, global equities and oil prices fell after a roller-coaster ride last week that marked the Dow Jones Industrial Average’s biggest weekly gain since 1938.

Monday’s decline came after the White House’s announcement on Sunday to extend social-distancing guidelines for another 30 days until the end of April. President Trump said the peak in the death rate from the coronavirus pandemic was expected to hit in two weeks, predicting the US would be on its way to recovery by 1st June.

Coronavirus cases world-wide topped 678,000, while its death toll surpassed 30,000. Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, projected that the disease would kill between 100,000 and 200,000 Americans and infect possibly millions.

Stimulus had just started

As lawmakers completed a record-shattering economic-rescue package estimated at USD2 trillion last week, Senate Minority Leader Chuck Schumer predicted that, “This is certainly not the end of our work here in Congress — rather the end of the beginning.”

Legislators from both parties, administration officials, economists, think tanks and lobbyists are already roughing out the contours of yet another emergency-spending package — perhaps larger than the last — to try to keep the coronavirus crisis from turning into a 21st-century Great Depression. Many expect the debate to begin in earnest by late April.

There’s talk of a multi-trillion-dollar program, given the size of the shutdown, a general recognition that we need something big to get some juice into the economy. The ideas being floated include extending last week’s package to make the benefits last longer, as well as plugging in likely holes in the hastily assembled bill. One item in particular cited by both President Trump and Democratic leaders is a desire for more money to shore up state government budgets collapsing under lost tax revenues and new spending demands.

A common theme from economists and legislators across the political spectrum: The latest measure was mainly about keeping US commerce on life support while it endures a medically induced coma. That is, paying businesses and workers revenues and wages lost during the shutdown. A next phase would likely pivot from stabilisation to stimulus — providing the patient a robust regimen of physical therapy in an attempt to get the economy back to full health.

Our Picks

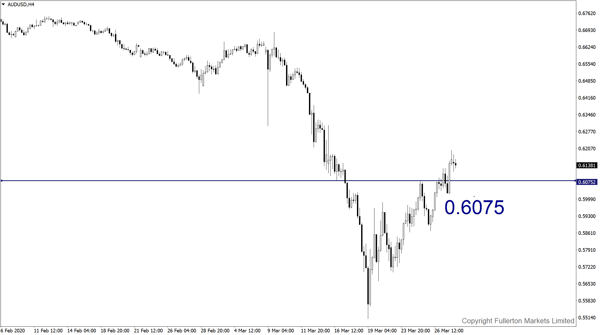

AUD/USD: Slightly bearish

The pair may fall towards 0.6075 this week

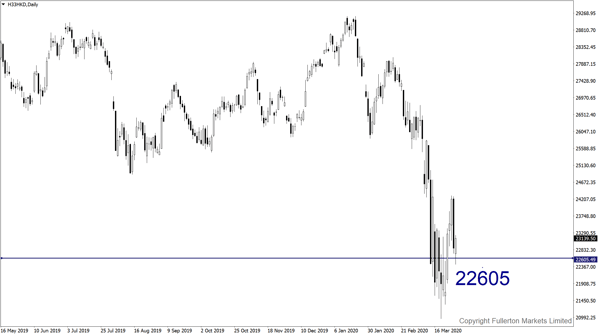

Hang Seng Index: Slightly bearish

Index may drop to 22605 this week

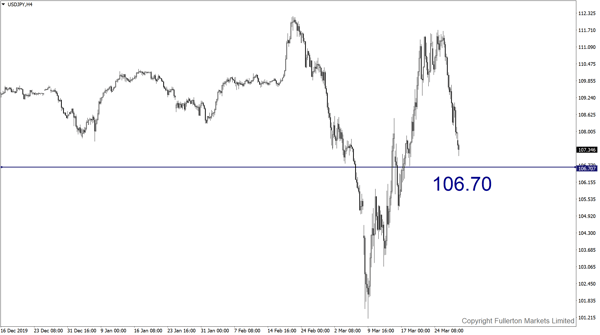

USD/JPY: Slightly bearish

This pair may drop towards 106.70 this week

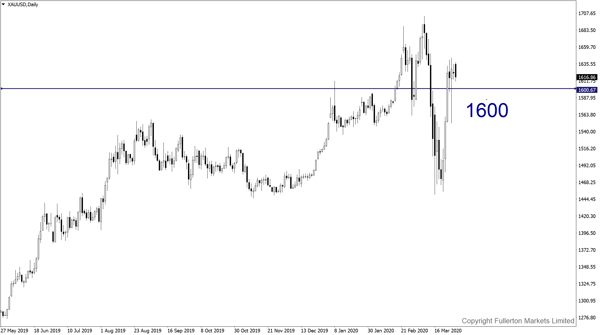

XAU/USD: Slightly bearish

This pair may drop towards 1600 this week

Fullerton Markets Research Team

Your Committed Trading Partner

Markets Want More, Can You Deliver?">

Markets Want More, Can You Deliver?">