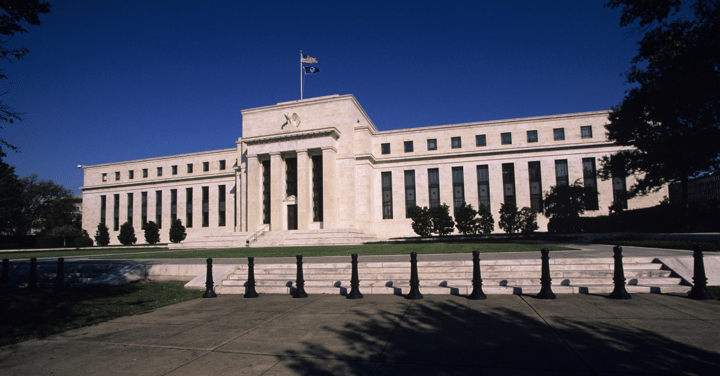

Did Fed Hint Investors To Sell Stocks And Buy Dollar?

As a major support system for Wall Street, the Fed is going its own way these days, taking on the inflation fight. Its leading officials say it is pivotal to protect the U.S. economy, even if it...